Liquid lending is a system where you can borrow or lend cryptocurrency directly to others, without needing a bank. You earn interest lending out your crypto, or you can borrow funds using your crypto security. Think of it this way: you need cash but don’t want to sell your crypto. Liquid lending lets you borrow money using your crypto security. It’s a way to access funds without selling your assets, all done automatically by smart contracts on the blockchain. These smart contracts are simply digital agreements that run themselves, ensuring automated and fair execution. Just use platforms like Aave and Compound.

Takeaway Points:

- Liquid lending allows you to earn interest by lending out your crypto or borrow funds using your crypto security.

- While it offers potential upsides like better yields and easier borrowing, it’s important to know the risks, including smart contract problems and market swings.

- Informed participation, careful platform choice, and risk management are key for being involved safely.

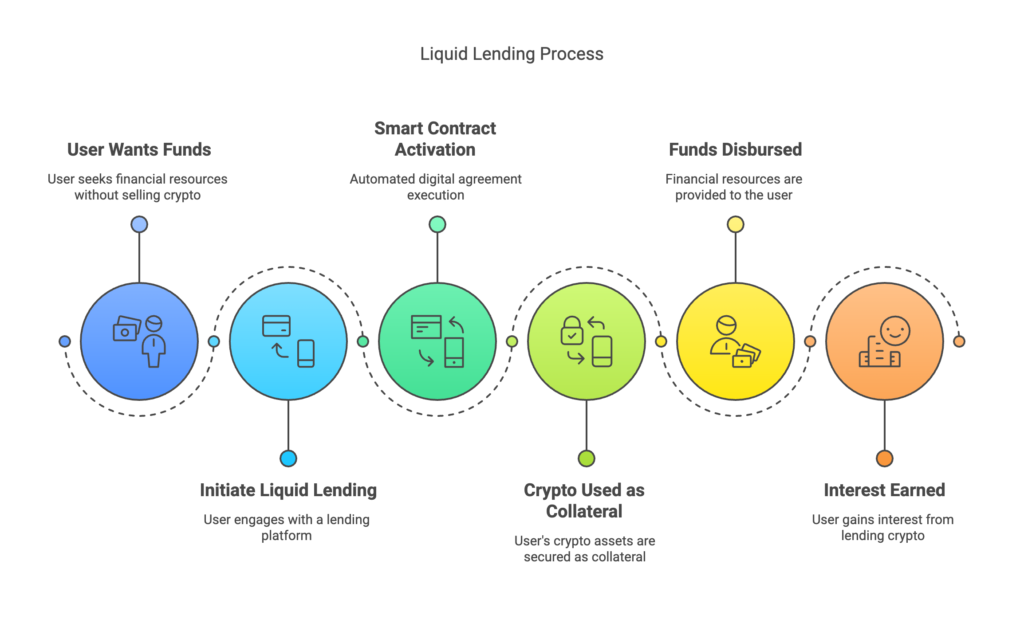

How Liquid Lending Works

The process is simple. Deposit your crypto – Bitcoin or Ethereum, for example – into a lending “pool.” You earn interest. Interest rates change depending on demand. Someone can borrow from the pool, providing their own crypto security. If the borrower defaults, their security is sold to repay the lenders. This “liquidation,” protects lenders.

Why Liquid Lending Keeps Growing in 2025

There are several reasons why liquid lending could become more common. More people are using cryptocurrency, so we naturally need more ways to manage and use those assets. Financial groups are also looking at DeFi and liquid lending, which means money is flowing into the space. Plus, the technology is getting better, making the platforms easier for everyone to use. Finally, regular savings accounts pay so little interest, and liquid lending offers a chance to earn more on your crypto.

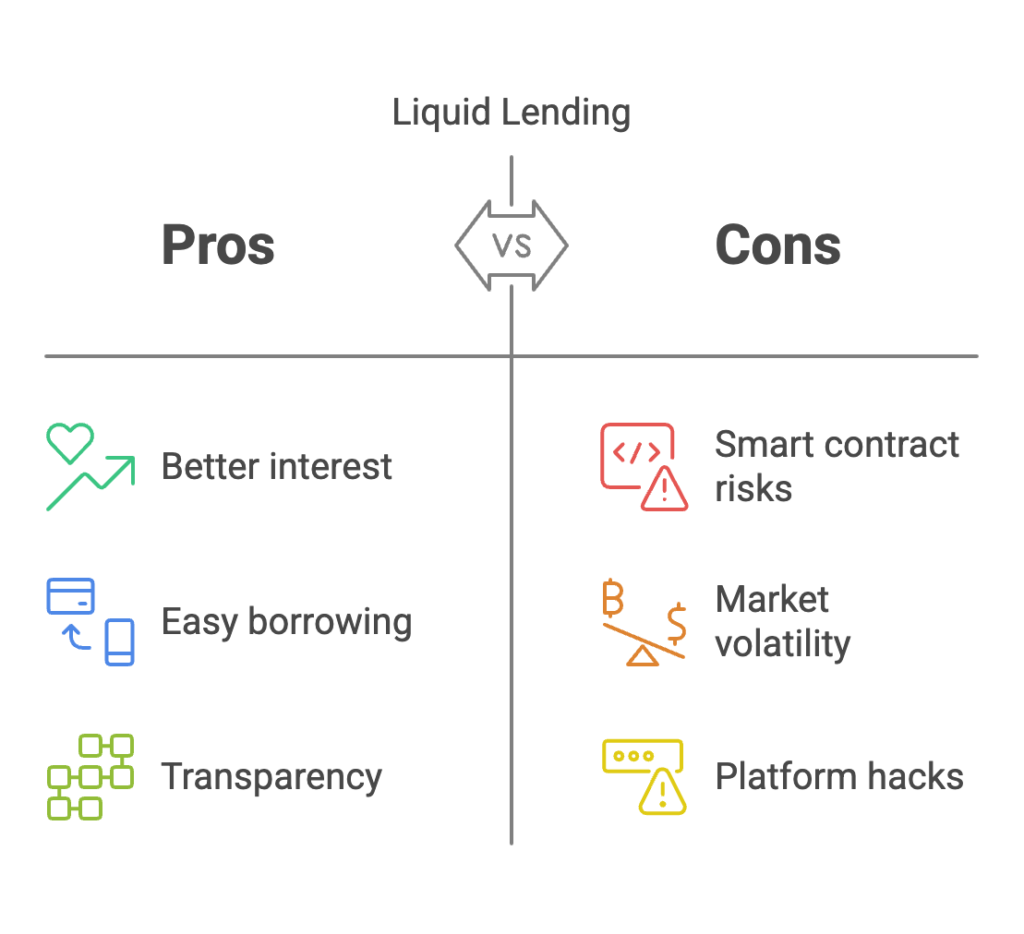

The Advantages of Liquid Lending

The good things about liquid lending are clear. One key plus is the chance to earn better interest than regular savings accounts. When interest rates are low, liquid lending offers a way to make more from your crypto.

Another clear benefit is easy borrowing. Regular loans often require lots of paperwork and credit checks. Liquid lending makes it easier to get funds, using your crypto security.

Also, things are open. Transactions happen on the blockchain; all activity is public. This makes things more open than in regular financial systems.

Risks of Liquid Lending

While it looks good, liquid lending has risks you should know. One main risk is problems with smart contract code. Bugs or issues in the smart contracts could let hackers steal funds.

Market changes are also a risk. Crypto prices can change a lot and fast. If your security loses value quickly, it could cause liquidation, leading to losses.

Finally, platforms can be hacked. Even with good security, a platform could be broken into, and users’ funds could be stolen.

Participating Safely in Liquid Lending

Liquid lending offers good chances, but you need to know the risks and steps to reduce them. Being informed helps you protect assets. Use these guidelines to be involved safely:

Carefully check out platforms and pick those with good security and a good name. Look for platforms checked by trusted security firms.

Start small and learn before putting in large amounts. This lets you get used to the platform and the process without risking a lot.

Be sure you know about liquidation and what can cause it. Knowing the liquidation point and watching the value of your security can help avoid surprises.

Keep up with industry news and latest security info. The DeFi world changes a lot, so staying informed helps. Keep an eye on your investments.

Conclusion

Liquid lending offers can be both good or volatile, relative to your risk appetite. It allows for better returns and easier borrowing but brings threats like smart contract problems, market changes, and hacking. Being responsible means doing good research, being careful, and knowing the risks. If done right it can be a game changer in how we think about lending.